How to Calculate Ot Malaysia

Rate is calculated based on the amount set for specific OT hours. The OT is calculated based on.

Overtime Calculation Formula In Excel Youtube

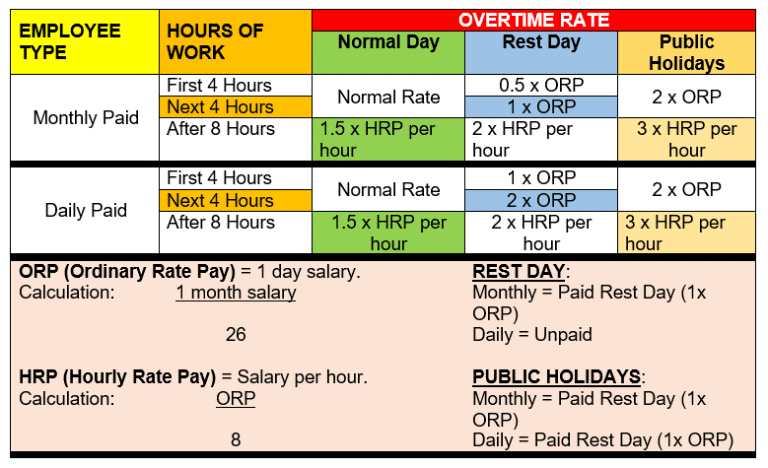

Working Hours Wages Malaysia Subject Formula Example Ordinary rate of pay daily pay Monthly pay eg minimum wage number of working days ordinary rate of pay RM1000 26 days RM 3846 Hourly rate pay Daily pay normal hours of work hourly rate pay RM 3846 8 hours RM 480 Overtime work during normal day 15 x hourly rate pay.

. The overtime calculator pay is. A The formula for calculating OT amount in our system. There are laws governing the hours of overtime work for employees in Malaysia.

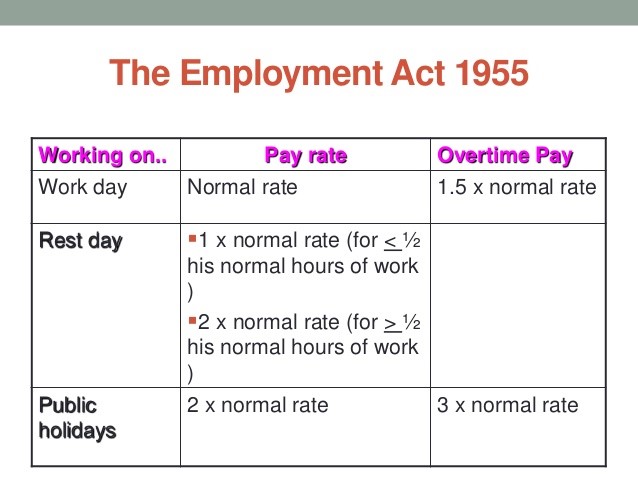

As per Employment Act 1955 Malaysia the employee shall be paid at a rate not less than 15 times hisher hourly rate for overtime work in excess of the normal work hours. How to do Payroll Calculator. Net Pay Basic Salary Overtime Employee EPF Employee SOCSO Employee EIS.

In this article we will study the laws governing the hours of work and overtime work for employees under Malaysias labour laws. In this article we will explain a few things about overtime. Hourly rate of pay means the daily rate of pay divided by the normal hours of work as agreed between the employers and empoyees.

In Malaysia overtime is still popular among companies especially in the FB sector. Overtime on normal work days. For guide on calculating hourly rate of pay kindly refer to Calculation for Overtime Payment.

Calculation of overtime on Public holiday PH which is recognised by employer. One day this employee works. For example an employee who works 8 hours a day for a monthly salary of RM260000.

In excess of eight 8 hours-. RM1200 RM115384 RM132 RM625 RM250 RM10707884. Compute your ordinary rate of pay or daily rate.

By multiplying it by 100 the result will be 1000. The same employees hourly rate of pay would be RM1250 RM100 8 hours RM1250---. For employees with salary not exceeding RM2000 a month or those falling within the First Schedule of Employment Act 1955 the laws in respect are spelled out in the Employment Act 1955.

Everything there is to know on how to deal with this calculation is explained below the tool. Salary Calculator Malaysia for Payroll System. - 05 x ordinary rate of pay half-days pay More than half but up to eight 8 hours of work-10 x ordinary rate of pay one days pay In excess of eight 8 hours-20 x hourly rate x number of hours in excess of 8 hours.

Basic pay 26 days X 30 X hour of works. The steps below will guide all levels of excel users through the process. For any overtime work carried out in excess of the normal hours of work the employee shall be paid at a rate not less than one and half times his hourly rate of pay.

LHDN Malaysia do not accept manual submission. For work on a rest day the pay shall be no less than 20 times the hourly rate and on a public holiday no less than 30 times the hourly rate. For example an employee who works overtime on a fixed schedule.

The law on overtime. 15x one and a half salary. In addition to the PH pay employees get OT of 2 times the ORP for one day.

Total pay for overtime. Any hours exceeding normal working hours is paid at 3 times the hourly rate of pay. Hourly rate of pay.

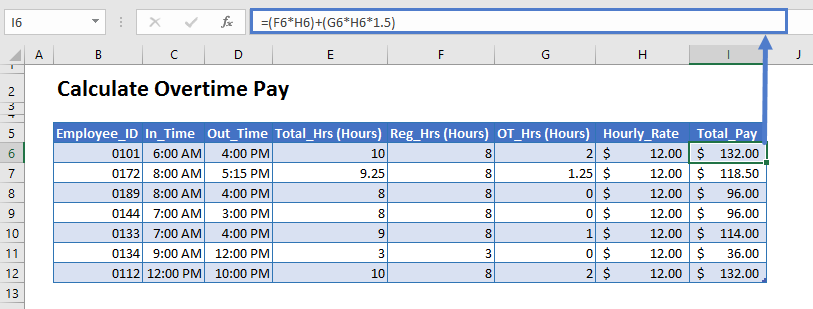

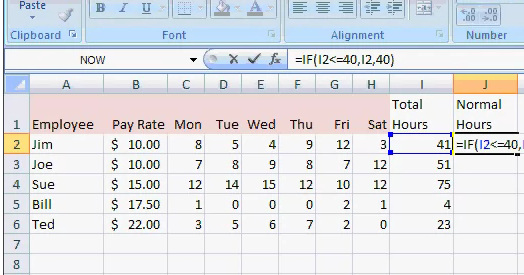

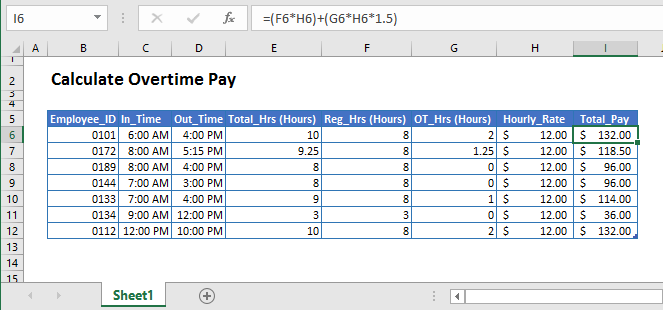

Hourly employees are the easiest to calculate overtime pay for. Overtime on Normal Working Day. In this case the formula would be Regular Rate Straight Time Regular Rate 1.

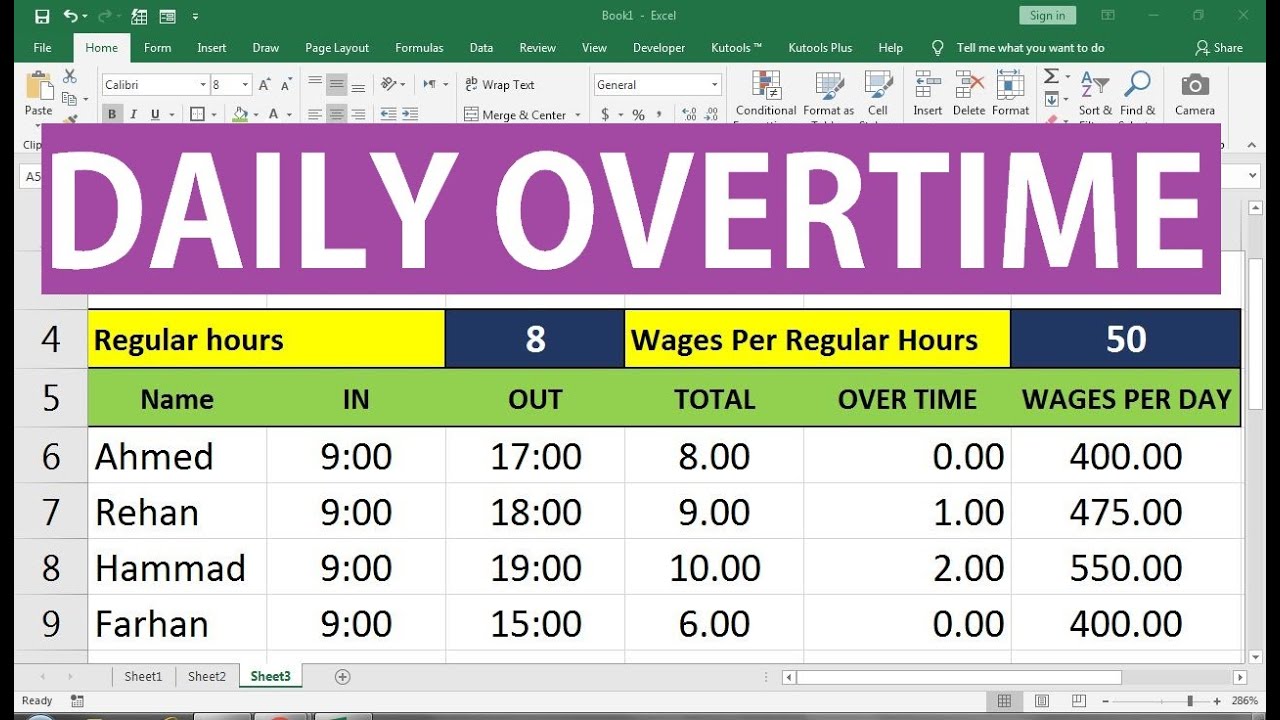

If the employees salary does not exceed RM2000 a month or falls within the First Schedule of. Heshe will have an ordinary rate of pay of RM100 RM2600 26 RM100. Daily salary An employee works normal working hours of 8 hours a day earning RM50 on a daily basis.

1 hour rate x OT rate x hours worked OT amount. We can use a set of formulas to calculate the pay associated with workers working overtime. It must first be understood that the entitlement for overtime pay under the Employment Act 1955 is only applicable to employees with wages not exceeding RM2000 a month or those falling within the First Schedule of Employment Act 1955.

B Ordinary rate pay is the amount used to calculate OT amount. SalaryOT working days in a monthstandard working hours 1 hour rate. In the PayrollPanda app you can use the preset overtime item.

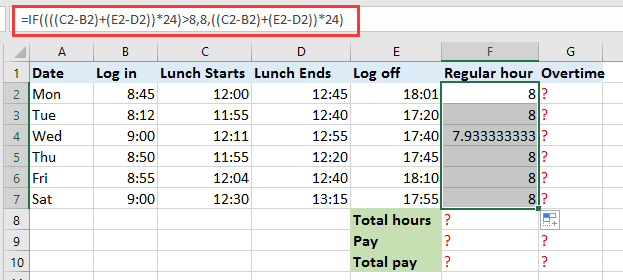

In Swingvy weve computed the default overtime setting for the country that is located in Malaysia and Singapore. How Do You Calculate Overtime Rate. General Formula regular timerate overtimerate15 Formula.

The pay for overtime work shall be at a rate of not less than 1. Normal working day 15 Basic pay 26 days X 15 X hour of works. Overtime Calculator This overtime calculator figures your total overtime paycheck and the OT rate together with the regular pay by taking account of the number of hours worked.

Calculate overtime by dividing regular hours by overtime. More than half but up to eight 8 hours of work-10 x ordinary rate of pay one days pay iii. MYR 1400268 x 15 MYR1010.

The pay for overtime work shall be at a rate of not less than 1 ½ time of the employee hourly rate of pay. Multiply your hourly rate by the number of overtime hours and overtime rate. How OT hours are calculated based on Seksyen 60 3 Seksyen 60 1 Employment Act 1955.

The overtime rate shall be 15 x Hourly Rate x Number of Hours Worked b. Divide your monthly salary by 26 to get your daily rate. Calculate your overtime pay.

Not exceeding half his normal hours of work-05 x ordinary rate of pay half-days pay ii. Rate is calculated based on the OT hours. How to Use Basic overtime calculation formula.

But overtime can be a very confusing matter. A non-workman earns MYR1400 a month and works 2 hours of overtime calculator. So when an employee works 8 hours a day for a monthly salary of RM2600 heshe will have an ordinary rate of pay of RM100 Monthly salary 26 RM2600 26 RM100.

RM50 8 hours. Working on Public Holiday. How to calculate Ordinary Rate of Pay and Hourly Rate of Pay.

Overtime on rest day Employee who works overtime on rest day not exceeding half hisher normal hours of work. Overtime on Public Holidays. RM2404 x 20 x 20 RM9616.

When an employee works 8 hours a day for a monthly salary of RM2600 the same employees hourly rate of pay would be RM1250. Overtime hours 3 hours Overtime pay Hourly rate X Overtime hours X Overtime rate RM 8 X 3 X 15 RM 36. The laws in this respect are spelled out in the Employment Act 1955 the EA.

10x one day salary. Working on Off-day 20 Basic pay 26 days X 20 X hour of works. Divide the employees daily salary by the number of normal working hours per day.

Overtime on rest days.

Your Step By Step Correct Guide To Calculating Overtime Pay

How To Calculate Overtime Pay In Excel Accounting Education

Excel Formula Basic Overtime Calculation Formula

How To Quickly Calculate The Overtime And Payment In Excel

Ove Foreign Workers In Malaysia Info News That Matter Facebook

How To Calculate Overtime Pay For Employees In Malaysia Althr Blog

Overtime Calculator For Payroll Malaysia Smart Touch Technology

How To Quickly Calculate The Overtime And Payment In Excel

How To Quickly Calculate The Overtime And Payment In Excel

Your Step By Step Correct Guide To Calculating Overtime Pay

Your Step By Step Correct Guide To Calculating Overtime Pay

Your Step By Step Correct Guide To Calculating Overtime Pay

Your Step By Step Correct Guide To Calculating Overtime Pay

Calculate Overtime In Excel Google Sheets Automate Excel

Excel Formula Timesheet Overtime Calculation Formula Exceljet

Your Step By Step Correct Guide To Calculating Overtime Pay

Overtime Calculator For Payroll Malaysia Smart Touch Technology

Belum ada Komentar untuk "How to Calculate Ot Malaysia"

Posting Komentar